- AVERAGE HOUSEHOLD MONTHLY EXPENSES HIGH INCOME HOW TO

- AVERAGE HOUSEHOLD MONTHLY EXPENSES HIGH INCOME PRO

While I don’t have a set percent here, I can give you some national averages of what Americans spend on groceries each month in the “moderate” spending range: 2 When we’re not making or eating food, we’re thinking about food, right? (Well, I know I am.) It’s no wonder this budget line is one of the hardest to keep on track.

AVERAGE HOUSEHOLD MONTHLY EXPENSES HIGH INCOME PRO

Pro tip: Learn more about walking the 7 Baby Steps. This time, I do have a solid percent for you: At this stage of the game, you should be investing 15% of your gross income for retirement savings. Wealth Building: The last reason to save up money is for wealth building. Once you’ve paid off your debt and are sitting on top of that fully funded emergency fund, it’s time to start saving for the future! Just remember-the more money you throw at a goal, the quicker you get there! (Disney can wait!)Īgain, there isn’t a set percentage here. Keep your eyes on your stuff so you’ll know when to put money in savings for those necessary big purchases.Īnd what about the fun big purchases-like Disney vacations or new furniture? You should save up cash for these too! But hear me clearly on this: Get to the luxuries after you’re debt-free and have real financial security. But when you know your 30-year-old Jeep is hanging on by duct tape and prayer, that’s when you start saving for a replacement.

The key word here is know. When your car breaks down, to your complete surprise, that’s a job for the emergency fund. Basically, if you don’t have one yet, you need to cut back on any extras-so you can get intentional and intense about building your savings-until your emergency fund is full.īig Purchases: Another reason to put money in savings is so you can pay cash for big purchases. This includes saving up for a reliable car to replace the one you know is on its last legs (or. The thing is, there isn’t a set percentage of your income you should put toward your emergency fund each month. This is 3–6 months of expenses and will protect you against bigger emergencies, like job loss. When the debt’s gone, you need to save up a fully-funded emergency fund (Baby Step 3). If you’ve got debt (which I’ll cover later) keep that emergency fund at $1,000 until you’re debt-free (which is Baby Step 2). (I call that a starter emergency fund, or Baby Step 1.) This puts a cash buffer between you and those life happens moments.

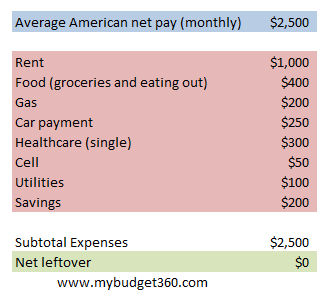

Since budget percentages for these can vary, let’s talk through each one.Įmergencies: Set aside $1,000 in the bank right away. When it comes to the savings category of your budget, think about these three reasons to save: emergencies, big purchases and wealth building. How much you’re putting in savings each month depends on several things! 1 But this is a great example of how a percentage or even an average shouldn’t set a standard for you. If you’re wondering what’s typical here, the average American saves around 9% of their income.

AVERAGE HOUSEHOLD MONTHLY EXPENSES HIGH INCOME HOW TO

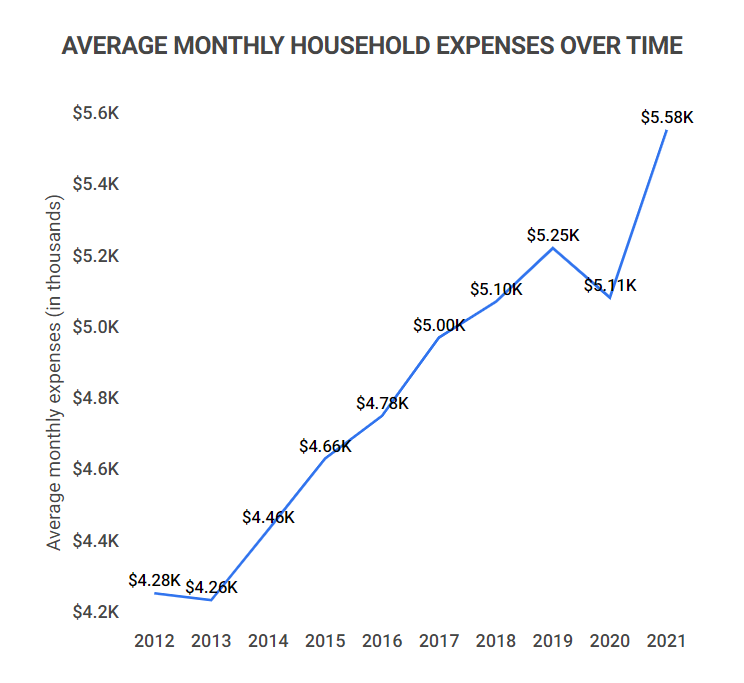

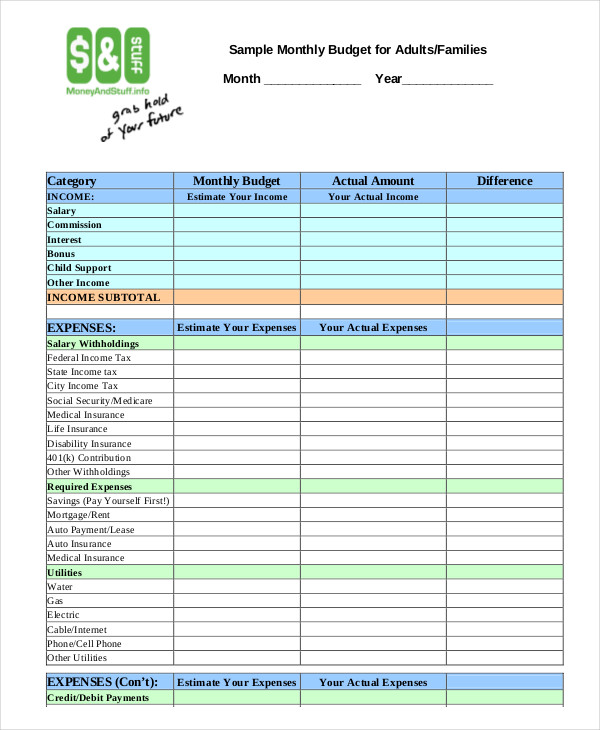

(Aka how to win with money.) The Baby Steps tie in with how much you should spend in a few of these budget categories-especially savings. This is the proven, guided path to save money, pay off debt, and build wealth. Heads up: I’m about to talk about the 7 Baby Steps. So, before we dive in, here’s an overview of the budget categories we’ll cover in this article: Look up your own! Open your online bank account or get out those bank statements and see what your past spending reveals. Or maybe a category is like a playlist, and the lines are like songs.Īlso, if you’re reading this as you set up your first budget, don’t stop with the numbers I’m about to give you. If those words are new to you, think of a budget category as a folder, and the budget lines as files inside it. Let’s break down some national averages and budget percentage recommendations for common budget categories and budget lines. Guidelines for Setting Your Budget Percentages So, I’ve pulled them together with other helpful info to guide you as you’re setting up (or fixing up) your budget! Are you ready for this? Because your life isn’t one size fits all! How much you should spend on this and that in your budget can vary depending on your income, household, location, goals, lifestyle-so many things.īut there are a few standards to follow. If you’ve never budgeted before-or you’re wondering how your spending compares with everyone else’s-you might wish you could see some recommended budget percentages, national spending averages, and other helpful stuff like that all in one place.Īnd listen, I’m not about to give you a one-size-fits-all budget percentage guide.

0 kommentar(er)

0 kommentar(er)